In Kenya, filling your kra pin is necessary to avoid paying penalty fee. You can avoid those changes by filling your kra before the deadline. If you are a Kenyan citizen processing a valid kra pin, then you are required to declare your annual income yearly. If you are not employed, for instance you are a student. You can file nil returns on your kra portal without failure. Hopefully, you will learn how to file your nil returns in this article. Before we take you through the process of filling, you must know what is required.

requirements for filling nil returns

Before we take you through, the following things are very important. Make sure that you have;

• Your kra pin number

Your kra pin number is a crucial requirement when filling your returns. In case you have forgotten your kra pin, you can request for a new one.

• Your iTax password

This is another crucial requirement before filling your returns. The iTax password is required before gaining access into your iTax kra account.

• Kra pin certificate

It is useful since you might require some information from your pin certificate.

• Kra iTax account

You must gain access into your account to file the nil returns.

If you have the above requirements, we can now take you through the process of filling nil returns.

Process of filling nil returns

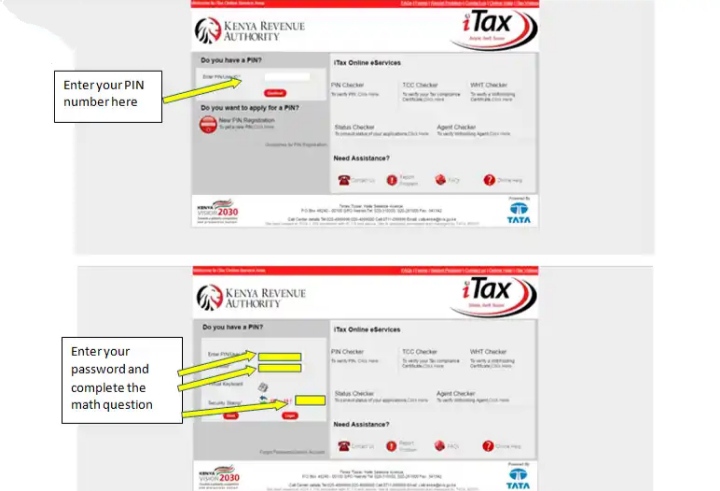

• Insert your kra pin or user ID, then click on the CONTINUE button to proceed.

• An empty tab will be opened, you will put your password and answer the simple arithmetic as you click enter.

• Given that you entered the right information, you will gain access to the website. On the red menu bar, click on returns icon. A drop down will then appear, choose File nil returns.

• You will gain access to a new page. On that page, fill as indicated below.

-on ‘type’ tab, fill self

-on “tax payer pin” put your kra pin

-on “tax obligation” fill income tax resident.

-click submit

• When your information is successfully submitted. You will come across an e-return acknowledgement receipt. Download the receipt and you would have successfully filled your returns. You can either email yourself or print the receipt for safety purposes. This is how you can file kra nil returns in Kenya, success in your filing process.

how to file subsequent nil returns on iTax mobile app

It might not be your first time to file the iTax form, then you can use the iTax Mobile App to file subsequent returns.

Steps to file subsequent returns

- Download the app on Google Play

- Log in with your iTax password and pin.

- Select file nil returns

- Choose resident or non resident individuals.

- Click Submit

We hope that you are now comfortable in filling your nil returns. We wish you all the best!!

also read Amount a government teacher pockets per month in kenya